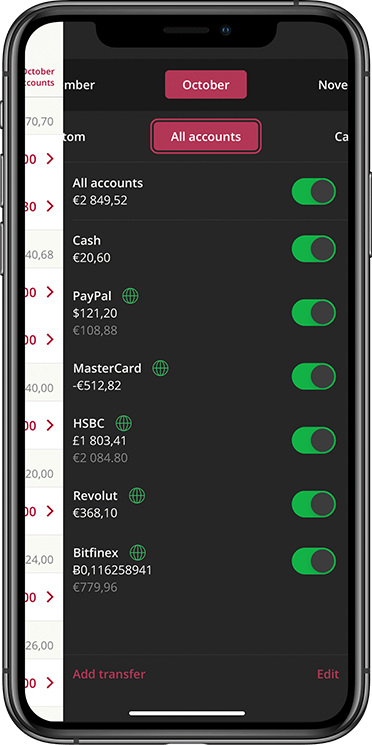

Where your financial accounts come together.

A bank account here, credit card there, payment services everywhere. Do you really want to cycle through all their apps just to see how much money you have on the account balances? Bring them all together in Toshl.

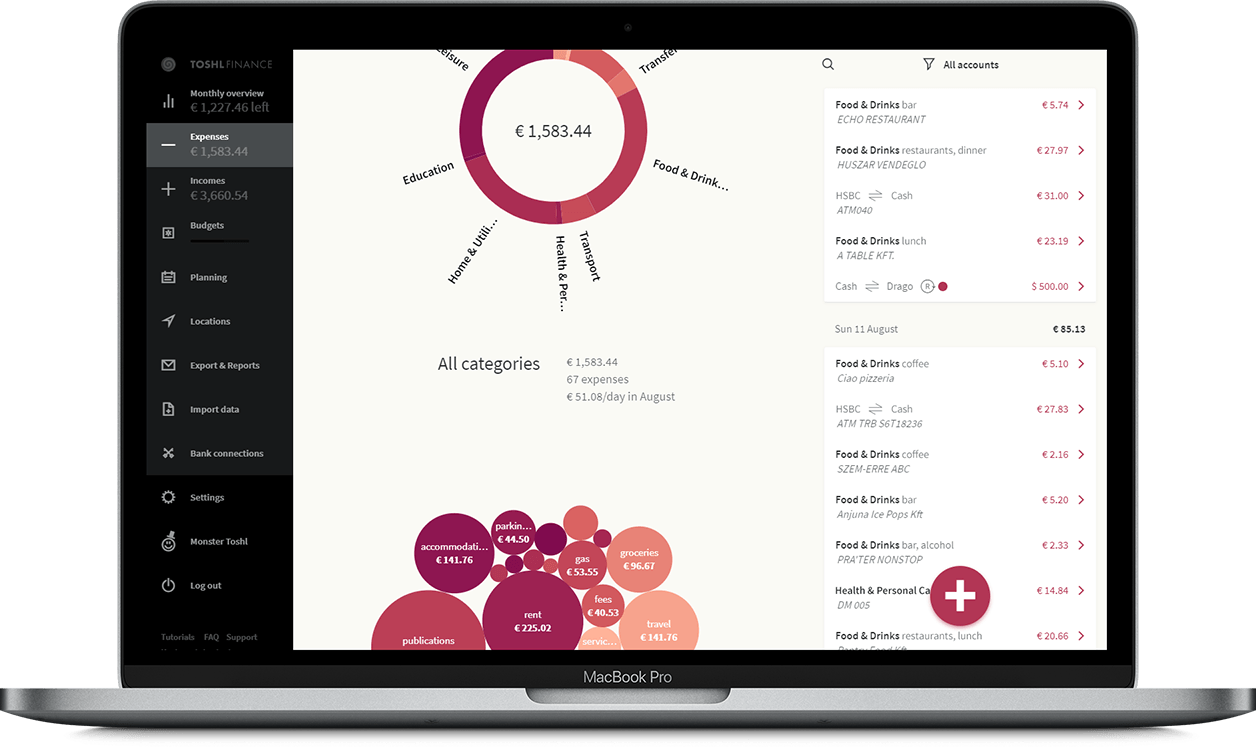

Automatic categorization that learns from you.

The mission: to distill meaning from gibberish. Toshl analyzes the transactions and automatically categorizes and tags them. They're then easier to understand at a glance and can be summed up by category. Made a category change? Toshl will automatically remember your choice for similar transactions in the future.

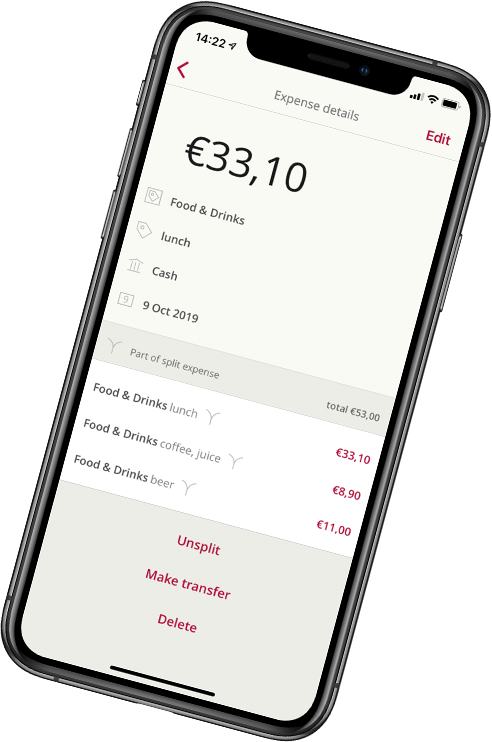

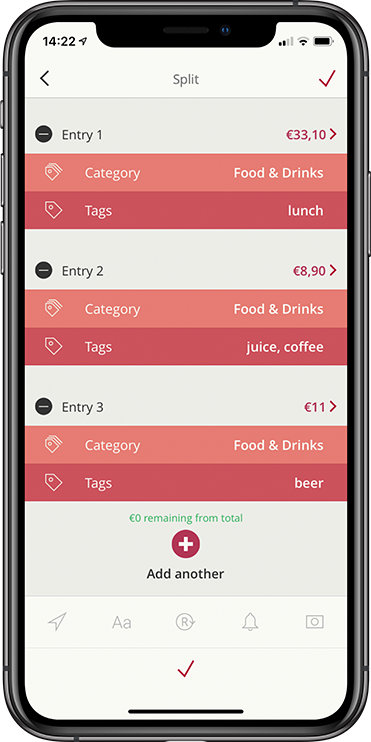

Splitting. Not just for bananas.

Let's say you went grocery shopping. If you bought at one store, that single expense amount might contain spending for several categories. For example, you bought groceries, but also some cosmetic products, a few home improvement items... In Toshl you can easily split that single amount and enter exactly how much you spent on what.

Safe and private.

We encrypt and tokenize. Follow latest security practices. Store only the data that's necessary. Make sure we have trustworthy partners to connect to banks and host the data. We provide two-factor authentication on your Toshl account for additional security. We are regulated by EU banking authorities and hold a PSD2 AISP registration with Bank of Slovenia.

More on how connections work and security

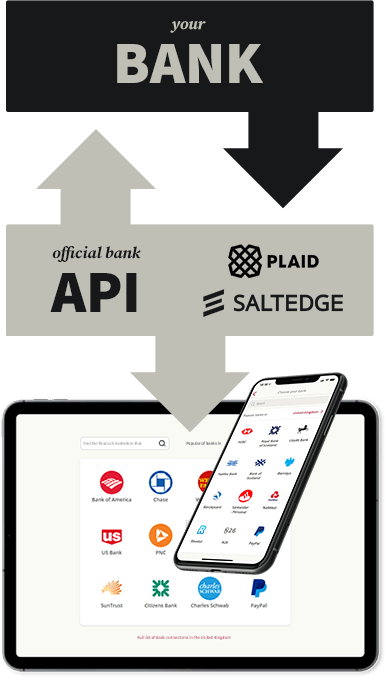

How do the bank connections work?

How the actual connection happens depends on how modern your bank is in their practices. If they offer an official API (automatic connection), you'll be redirected to their website to authenticate. The data is then imported. No credentials are stored and only your bank ever verfies them. All banks in the European Union must offer API connections.

If the bank is a bit behind the times, our bank connection partner needs to log in to your online bank with your credentials to automatically import the data. Credentials needed to log in are stored by our bank connection partner until you remove the connection. Some are fully automatic, while some require a multi-factor authentication code each time you update, again depending on your bank's systems.

Log in

Log in